Is it time to start thinking about when to apply for Social Security retirement benefits? Deciding when to apply for Social Security retirement benefits requires a look into the future.

How much money do I need to retire? How much income do I need to support my lifestyle? What happens if the stock market underperforms? How long will I live (longevity risk)?

Social Security retirement benefits represent a significant portion of a retiree’s income. The Social Security Administration is expected to payout out one trillion dollars in benefits to 65 million Americans during 2020. The average monthly retirement benefit in 2020 is $1,514.

You can sign up for Social Security retirement benefits as early as 62 years old. You can delay receiving these benefits until age 70. The longer you wait, the more your monthly benefit will be.

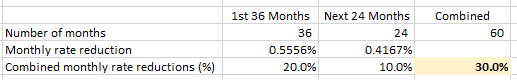

Applying early for Social Security retirement benefits reduces the monthly amount by 5/9 of 1% for each of the first 36 months and by 5/12 of 1% for months 37 to 60.

For example, an individual applying for Social Security retirement benefits at age 62 compared to the normal retirement age of 67 would receive 30% less in their monthly retirement benefit. The individual would be applying five years or 60 months prior to the normal retirement age. The reduction in the monthly benefit is calculated as follows:

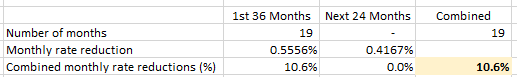

An individual applying for Social Security retirement benefits 19 months prior to the normal retirement age of 67 would have their monthly retirement cut by 10.6%. The reduction in the monthly benefit is calculated as follows:

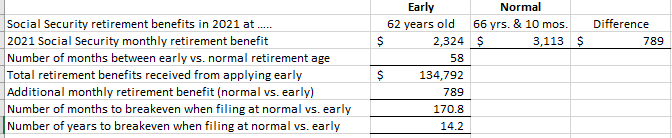

The following amounts are the maximum Social Security retirement benefit for 2021:

- $2,324 when applying at age 62

- $3,113 when applying at 66 years and 10 months (normal retirement age)

- $3,895 when applying at 70 years old

Calculating your break-even point………

Determining when to apply for Social Security retirement benefits includes calculating the break-even point. How many years will it take to recoup the dollars received when applying early for retirement benefits compared to waiting until the normal retirement age.

The break-even calculation comparing early versus normal retirement is below using 2021 amounts.

The break-even point is 14+ years when comparing applying early for Social Security retirement benefits at age 62 versus waiting until the normal retirement age. Applying early for Social Security retirement benefits is financially feasible up to the age of 76. Retirement benefits received after the break-even point will be $789 less compared to waiting until the normal retirement age. This equates to about $9,500 per year and if you are in good health and have a family history of longevity, it will be a substantial amount of lost retirement benefits if living into your 80’s and 90’s.

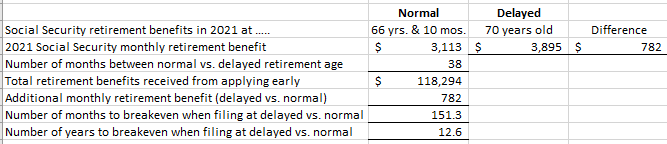

Delaying past your normal retirement age increases your Social Security retirement benefits by 2/3 of 1% (8% annually) for each month if born in 1943 or later. The below break-even calculation compares receiving benefits at normal versus delayed (70 years old) retirement age using 2021 amounts.

The break-even point is 82.6 years old if you delay receiving Social Security retirement benefits until 70 compared to applying for benefits at the normal retirement age. It will take you 12.6 years to recoup the benefits not received from ages 67 to 69.

2020 statistics project a 65-year old man can expect to live until 83 on average. A 65-year old woman can expect to live until the age of 86 on average.

Determining when to apply for Social Security retirement benefits is not a cookie-cutter approach since it involves personal factors and choices that go into the decision-making process.

Making an informed decision about your Social Security retirement benefits should include reviewing your data with the Social Security Administration.

Go to https://www.ssa.gov/myaccount/ to create your personal account.

Your account has your historical earnings record. It also projects estimated Social Security benefits at early (age 62), full or normal (age 67) and delayed (age 70) retirement age. Reviewing your earnings history will generate some nostalgic feelings when looking back at your high school or early post-high school employment years.

Social Security uses the following criteria to calculate your retirement benefits:

- combining your 35 highest years of earnings

- the annual earnings are $0 for each year you worked less than 35 years

- earnings are indexed to account for inflation, therefore those early year earnings get a boost

- the earnings to calculate your Social Security benefit is capped at the contribution and benefit base annual limit ($142,800 for 2021)

You need to be fully insured under the Social Security program to receive benefits. You must earn 40 credits to be fully insured. A credit is earned by working during any calendar quarter. An individual can earn up to four (4) credits a year. In addition, the minimum earnings for the quarter must be at least $1,470 in 2021 to earn a credit. The minimum earnings are adjusted every year based on the national average wage index. The bottom line is you need to work 10 years to be eligible for Social Security retirement benefits.

Married Couples Option

One way to pocket some extra money if you decide to delay receiving your Social Security retirement benefits is to apply for spousal retirement benefits. You can do this by filing a restricted application if you meet the following two conditions:

- Born prior to January 1, 1954

- Reach normal retirement age and you have not applied for your own retirement benefits

You can collect the spousal (or ex-spouse) benefit from your normal retirement age up to age 70. The spousal benefit amount is 50% of what your spouse (or ex-spouse) is entitled to receive.

Fling a restrictive application allows you to apply for a specific benefit and not all eligible benefits. This allows you to apply for a different type of benefit at a later date.

When reaching age 70, you would apply for Social Security retirement benefits under your own earnings record. Your monthly retirement benefit will have grown by 8% per year for each year you delayed claiming your own retirement benefits. The switch is based on your retirement benefit being higher than the spousal benefit.

Social Security retirement benefit quick facts:

- the normal retirement age is 67 for individuals born after 1959; birthdates prior to 1960 have various normal retirement ages

- Social Security benefits are reduced by $1 for every $2 earned when earnings exceed $18,960 in 2021 for a working individual below the normal retirement age

- Social Security benefits are reduced by $1 for every $3 earned when earnings exceed $50,520 in 2021 for a working individual reaching the normal retirement age during 2021 (until the month that normal retirement age is reached)

- Social Security benefits are not reduced once a working individual reaches normal retirement age

- There is no financial incentive to delay applying for Social Security retirement benefits after reaching 70 years of age

- You can change your mind within 12 months of applying for Social Security retirement benefits. You must repay the amounts previously received. Applying again at a later date will boost your monthly benefit.

- You can suspend your Social Security benefits between your normal retirement age and 70 years old if you applied to take early retirement benefits. Others receiving benefits under your earnings record will have their benefits suspended.

- Married individuals and ex-spouses who were married 10+ years can apply for Social Security benefits under their spouse’s earnings history. The spouse is eligible for 50% of the higher spouse’s Social Security benefit which may be higher than their own benefit.

- An ex-spouse is exempt from the rule that one spouse must file for their own retirement benefits in order for the other to be eligible for spousal benefits

When to start receiving Social Security retirement benefits is a difficult decision. It entails reading the Social Security Administration’s rules which can be confusing. You should consider all your personal circumstances, future lifestyle costs and sources of income. Your health and family history should be considered. Understanding the rules and preparing projections will help you make an informed decision.

Did you know Social Security issued their first check to Ida May Fuller on January 31, 1940 in the amount of $22.54.

Scott Melcher is a CPA and business advisor located in the Baltimore- Washington, DC region.

Recent Comments